The advance invoice - Everything you need to know about it as an entrepreneur

An advance invoice can be very useful for you as an entrepreneur when you often deal with long-term projects or when you need to purchase materials in advance. Below we will discuss what are the possible reasons to make an advance invoice, we will show an example of an advance invoice, all the things you need to mention on it and we will start with what it actually is:

What is an advance invoice?

Do you want to receive a part of the total amount before the full delivery of goods and services has taken place as an entrepreneur? Then you create an advance invoice. An advance invoice is a financial document that you send to the customer on which a part op the total amount is already invoiced. When the amount mentioned on the invoice is paid you start the work or deliver the goods.

What is very important with an advance invoice is that you agree the terms and amount with the customer before you issue the invoice. This can be done through the quotation. Be sure to check the local legislation, because in some countries there are legal restrictions on collecting advances.

In Belgium it is allowed to work with advances. However, the advance payment must be agreed on the quotation well in advance. Further on in this blog post you will see what elements need to be mentioned on an advance payment invoice.

Why would you use an advance invoice?

Using an advance invoice offers several advantages for both you as an entrepreneur and the customer. There are several reasons why you should choose an advance invoice. Here are some of these reasons:

Risk reduction for the business owner: Sometimes invoices are not paid. Receiving a part in advance already removes some of that risk.

Prefinancing expenses: It is often necessary for you as a business owner to incur some upfront costs before you can begin providing the services or goods. If you then receive an advance, these costs for purchasing materials or hiring staff can already be covered.

Customer commitment: An advance payment can also serve to ensure that the customer is serious about the partnership. When they pay the retainer, you can be sure that they are committed to completing the project.

Project financing: Projects can sometimes take a very long time. Therefore, for long-term projects it is convenient to work with advance payments, so that the project can already be financed without having to draw on your own capital.

Hedging cancellation risk: A customer can always cancel a project. If the advance is already paid, at least the costs already incurred for the project can be covered.

An advance payment should feel good to both parties and depends on the nature of the agreement and trust between the parties involved. Therefore, agreements on payment terms and guarantees are very important to be included in the agreement so that both you and your client are protected. Because it can greatly deter a client if they have to pay an advance when they do not know you as a business owner or when the amount involved is large.

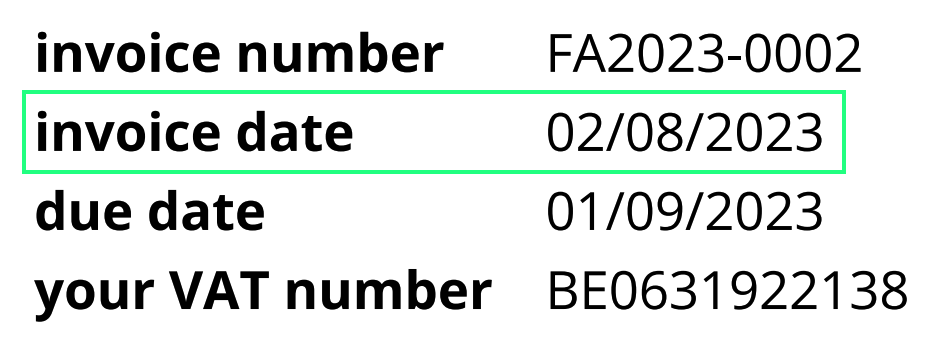

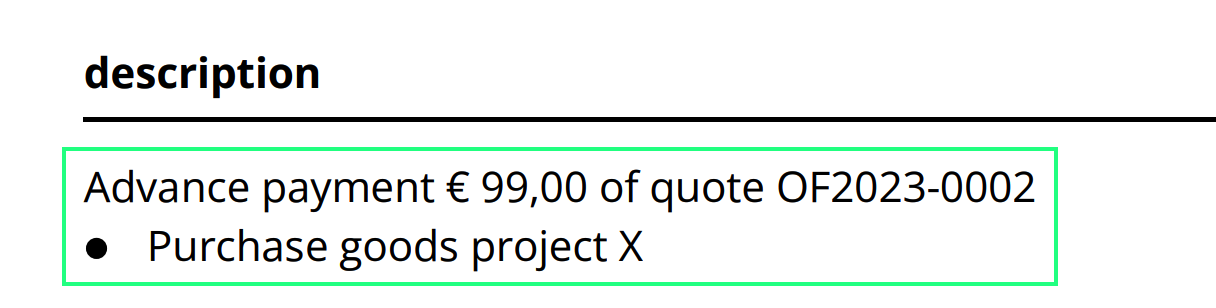

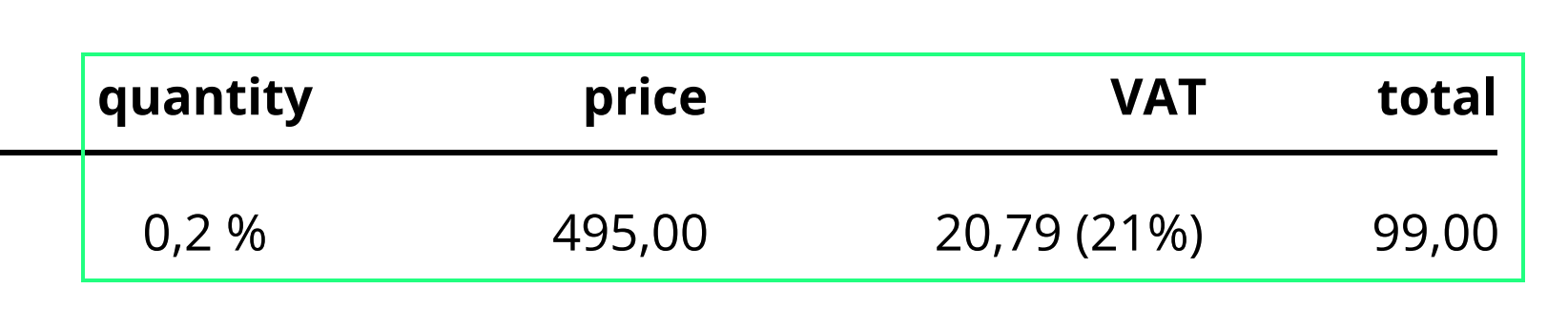

Example of an advance invoice

You can download the advance invoice example below here. You can read the detailed explanation of what should be on an advance invoice below.

What should be on an advance invoice?

The following elements are very important not to forget when creating an advance invoice:

Date the invoice was issued

The date should clearly appear on the invoice so that the customer knows when the invoice was created and when it should be paid.

Identification of the parties

Consider name, address and VAT number.

A clear description of the goods or services provided

For this you can use the same description that you used on the quotation. The description states exactly which goods and services the customer has agreed to and therefore what they are paying for.

The amount of the advance payment and the total invoice amount

The advance invoice also clearly states the exact amount of the advance payment. It is also convenient to include the total invoice amount.

The payment terms and any mention of an advance payment

You always include the payment terms with the advance invoice. This can also be mentioned on a seperate page. In this seperate page you can also mention how the advance payment works. This is also coordinated beforehand in the quotation.

How can you create an advance invoice?

How you can create an advance invoice depends on your invoicing program. In CoManage, you do this in four easy steps:

Step 1: Go to the approved quotation for which you want to create an advance invoice

Find the approved quotation in your quotation overview for which you want to create an advance invoice.

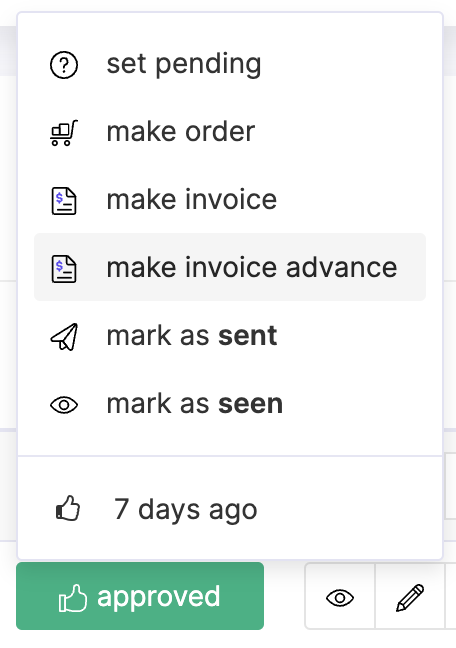

Step 2: Click on the approved status of the quote and then click 'create advance invoice'

Click on the status of the quote and then choose the option 'create advance invoice.'

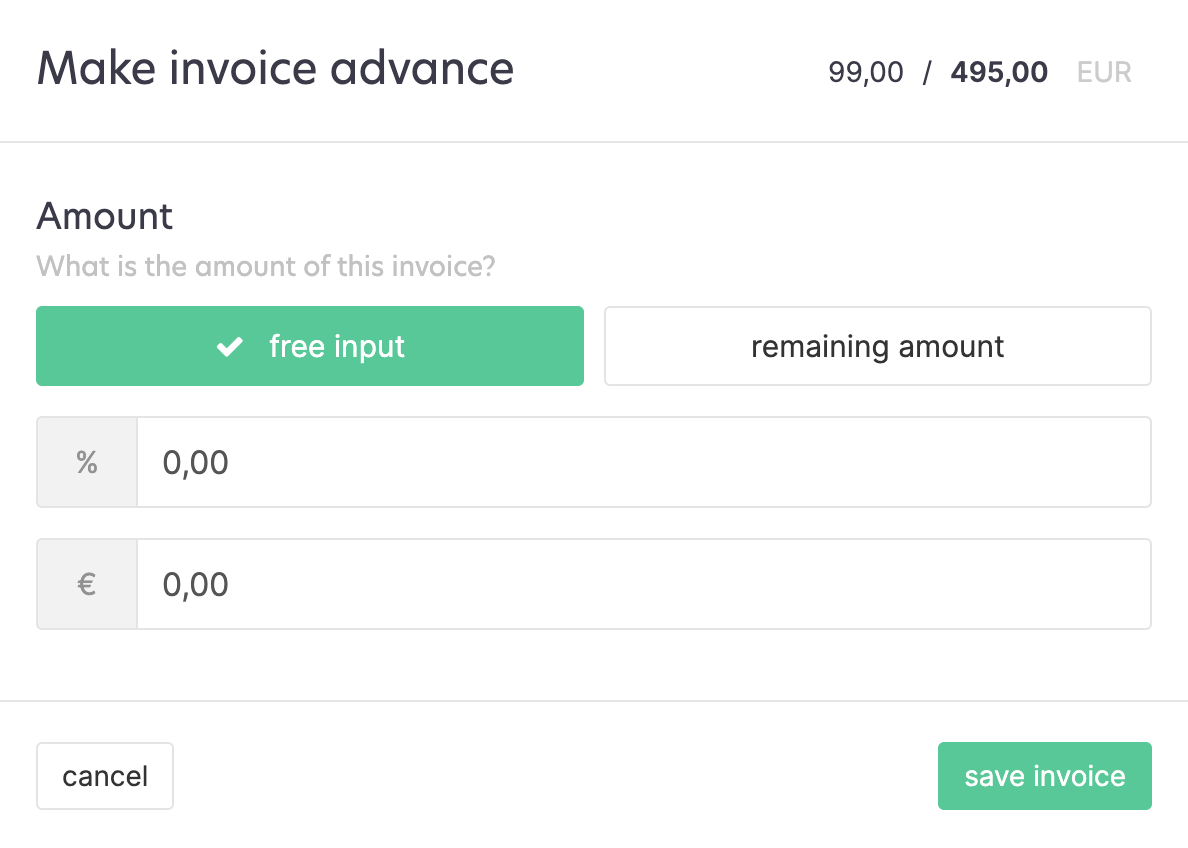

Step 3: Determine the amount of the advance invoice

Next, you will see a pop-up where you can choose whether to create an advance invoice based on a percentage or an amount. You fill this in to proceed.

Step 4: Send the invoice

The advance invoice is created for you and you can send it. You can either download it and attach it as a pdf to your own email or you can send it from CoManage. The invoice will also appear in your invoice overview.

If you want to create a new invoice for the same quotation or view the linked invoices, you can open the quotation and go to the 'Invoices' section. There you will find all linked invoices and you can add new advance invoices.